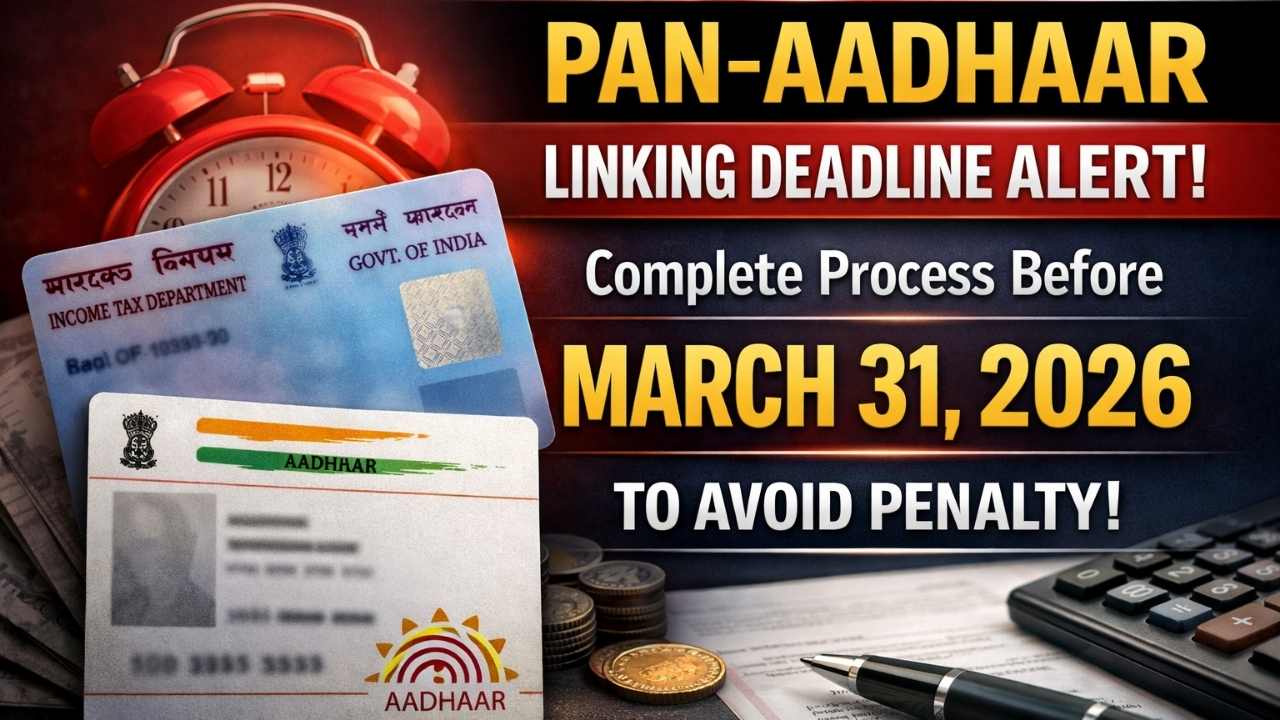

PAN Aadhaar Linking: Linking PAN with Aadhaar has become an important requirement for taxpayers in India. The government has set deadlines and rules to ensure that financial records remain accurate and transparent. Missing the linking deadline can lead to penalties and restrictions in using your PAN for essential financial activities.

Many people are still unsure about the latest deadline, penalties, and consequences of not linking their PAN and Aadhaar. Understanding the process, fees, and risks can help avoid future problems. This article explains the key facts, including deadlines, penalties, and how linking helps maintain smooth tax and banking operations.

Also Read: Bakri Palan Yojana 2026: Eligibility, ₹2 Lakh Subsidy And Application Steps

Importance Of PAN Aadhaar Linking For Taxpayers

Linking PAN with Aadhaar helps the government maintain accurate tax records and prevent duplicate or fake identities. It also ensures that financial transactions are properly tracked under a single verified identity.

For taxpayers, linking is necessary to continue using PAN for filing returns and financial purposes. It helps maintain compliance with tax rules and avoids interruptions in banking, investment, and official processes.

Latest PAN Aadhaar Linking Deadline Updates

The government had set a major compliance deadline for linking PAN with Aadhaar by the end of December 2025 for many individuals. Missing the deadline can make the PAN inactive from the start of 2026.

Also Read: Compare Top Banks Offering Home Loan Rates 2026: Starting From Affordable 7.10% Interest

Although earlier deadlines mentioned March 31 in past years, recent updates highlight that late linking is still possible. However, it may come with penalties and limitations until the PAN becomes active again.

PAN Aadhaar Linking Overview

| Key Detail | Information |

|---|---|

| Main Requirement | PAN must be linked with Aadhaar |

| Major Deadline | December 31, 2025 |

| Late Linking Fee | ₹1,000 |

| Status After Missing Deadline | PAN may become inoperative |

| Reactivation | Possible after linking and paying fee |

| Impact | Problems in filing returns and financial transactions |

Penalty Charges For Late PAN Aadhaar Linking

If the PAN and Aadhaar are not linked within the required timeline, a late fee is charged before completing the process. The current penalty amount is ₹1,000 for delayed linking.

This payment must be made online before submitting the linking request. Once the fee is paid and linking is completed, the PAN can become active again for normal use.

Also Read: Post Office PPF 2026 Investment Plan: How ₹50,000 Yearly Can Build Big Future Wealth

Consequences Of Providing Inoperative PAN

An unlinked PAN can become inoperative and may not be accepted for important financial tasks. This can affect return filing, tax refunds, and verification processes.

Using an inoperative PAN in financial transactions may also lead to additional penalties in certain cases. It can create complications in banking, loans, and other official activities.

How PAN Inactivation Affects Financial Activities

When PAN becomes inactive, many services linked to it may stop working properly. This includes filing income tax returns and processing refunds.

Also Read: Bank Holidays In March 2026: Holi Closures, Long Weekends, And Important Banking Schedule Details

Banks and financial institutions may also face issues in verifying identity. This can lead to delays in opening accounts, making investments, or completing large financial transactions.

Benefits Of Linking PAN With Aadhaar

Linking PAN with Aadhaar helps maintain a single verified identity for tax and financial records. It reduces chances of fraud and improves transparency in financial dealings.

It also makes tax return filing easier and smoother. Once linked, users can continue using their PAN without facing interruptions or restrictions.

Steps To Reactivate Inoperative PAN Easily

If a PAN becomes inactive due to not being linked, it can still be reactivated. The first step is to pay the required late fee online.

After payment, the linking request can be submitted through the official portal. Once the process is completed successfully, the PAN can become active again for regular use.

Who Must Link PAN With Aadhaar

Most individuals who hold both PAN and Aadhaar are required to link them. This is especially important for those who file income tax returns or carry out financial transactions.

Also Read: Gold Rate Slips ₹2,000, Creating Perfect Buying Opportunity Before Wedding Season Demand Surges

People who use PAN for banking, investments, or official identification should complete the linking. It helps avoid legal and financial complications later.

Final Thoughts

Linking PAN with Aadhaar is now an essential compliance step for taxpayers. It helps maintain smooth financial operations and ensures proper identification in official records.

Completing the process on time can help avoid penalties and prevent PAN from becoming inactive. Staying updated and taking quick action can save time and avoid unnecessary trouble.

Also Read: OPS 2026 Big Update Sparks Fresh Hope After Supreme Court Hearing for Government Employees