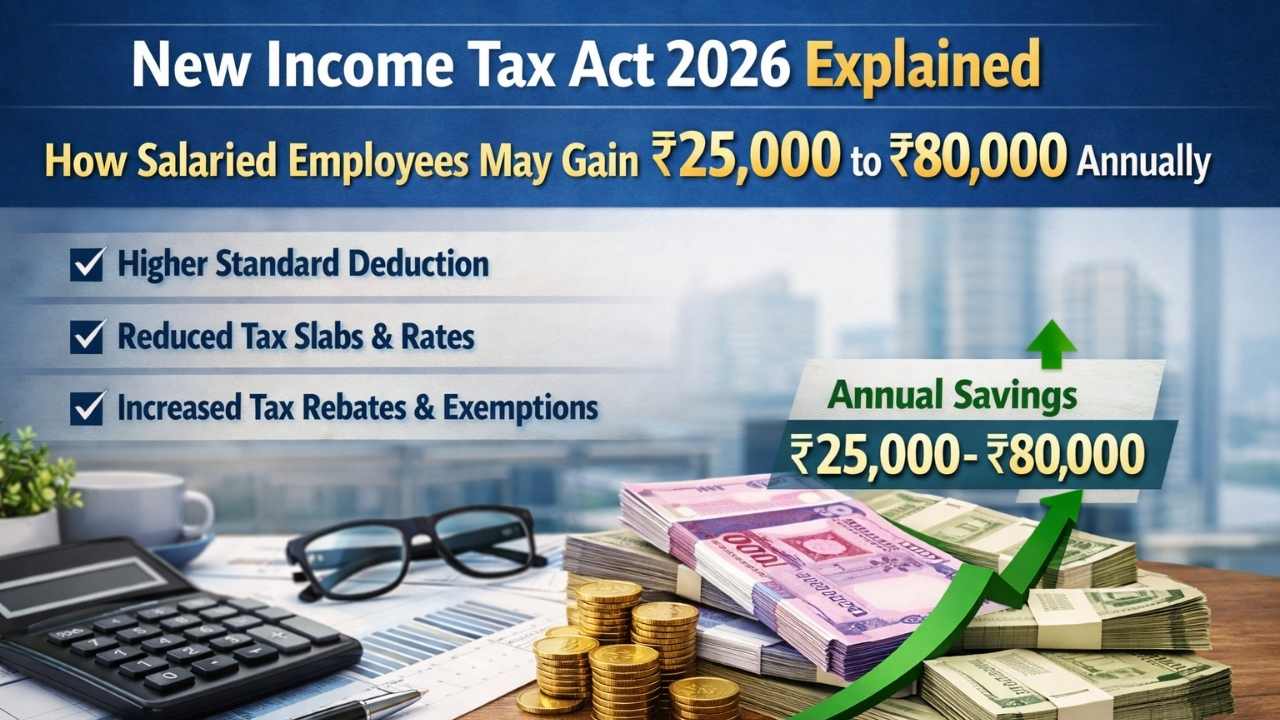

New Income Tax Act 2026: The New Income Tax Act 2026 has created strong interest among salaried individuals across India. Many reports suggest that annual take-home income may increase by ₹25,000 to ₹80,000 due to reduced tax burden and improved rebate benefits under the new tax regime.

However, this is not a direct salary hike announced by the government. The expected increase comes from tax savings, standard deductions, and lower tax liability for middle-income groups starting from the financial year 2026–27.

Also Read: Important RBI Update 2026: Inactive, Dormant, and Zero Balance Accounts Under Review

Understanding the New Income Tax Act 2026 Changes

The New Income Tax Act 2026 aims to simplify tax rules, reduce compliance issues, and make the tax system easier to understand. It is expected to come into effect from April 1, 2026, bringing revised guidelines and clearer provisions for taxpayers.

The focus is on improving transparency and making filing easier for salaried employees. Instead of increasing salary, the government aims to increase disposable income by lowering tax burden and maintaining benefits under the new tax regime.

How Tax Savings Can Increase Annual Take Home Salary

The claim of ₹25,000 to ₹80,000 extra income is linked to tax savings, not a pay raise. When tax deductions increase or liability decreases, monthly take-home salary can rise gradually throughout the year.

Also Read: New EPFO Interest Rate Update Signals Minor Reduction in Provident Fund Returns for FY26

Employees who fall into middle-income tax brackets may notice higher net income due to reduced deductions from salary. This can result in noticeable yearly savings depending on income level and chosen tax regime.

New Income Tax Act 2026: Overview Table

| Key Point | Details |

|---|---|

| Law Implementation | Expected from April 1, 2026 |

| Salary Increase Claim | ₹25,000–₹80,000 annually (estimated savings) |

| Reason for Increase | Lower tax burden and improved rebates |

| Direct Salary Hike | Not announced |

| Main Beneficiaries | Salaried middle-income taxpayers |

| Zero Tax Limit | Around ₹12 lakh under new regime with rebate |

| Standard Deduction Impact | Helps reduce taxable income |

| Applicable Financial Year | FY 2026–27 |

Who May Benefit Most From the New Tax Rules

Salaried individuals earning between ₹7 lakh and ₹20 lakh annually are expected to benefit the most. Their tax burden may reduce through rebates and simplified deductions under the new tax system.

Employees shifting to the new tax regime may also notice improved savings. Middle-class taxpayers will likely see the biggest impact in terms of increased disposable income and lower monthly tax deductions.

Also Read: Kalyan Jewellers Share Target Price 2026–2030: Long-Term Investment Potential And Market Outlook

Impact of Standard Deduction on Net Income Growth

Standard deduction plays a key role in reducing taxable income for salaried individuals. Even small adjustments in deduction amounts can result in meaningful yearly tax savings.

When taxable income decreases, the tax payable also reduces. This indirectly increases the take-home salary over the year, helping employees retain more of their earnings.

Role of Tax Rebates in Increasing Disposable Income

Tax rebates under existing provisions continue to support lower and middle-income groups. Individuals earning within certain limits can reduce their tax liability significantly using rebate benefits.

Also Read: Bank Working Hours Changed From 1 February 2026? Viral Message Truth Every Customer Must Know

These rebates reduce the amount deducted through TDS each month. As a result, employees may see higher monthly income, which adds up to annual savings over time.

Comparison Between Old and New Tax Regimes in 2026

Both old and new tax regimes continue to exist in 2026, allowing taxpayers to choose the one that benefits them the most. The new regime focuses on lower rates with fewer deductions.

The old regime still offers various exemptions and deductions. Individuals must compare both options carefully to determine which one gives them better tax savings and higher take-home income.

Also Read: New BSNL 65-Day Recharge Plan 2026 Brings Unlimited Voice Calling With Long Validity Benefits

Expected Monthly Salary Impact for Middle Class Employees

Tax savings spread across the year may increase monthly take-home salary slightly. This could range from a few hundred to several thousand rupees depending on income and deductions.

Over 12 months, this gradual increase may total ₹25,000 to ₹80,000 annually for some individuals. The exact amount varies based on salary structure and tax planning choices.

Implementation Timeline and Financial Year Applicability

The new rules are expected to be implemented from April 1, 2026. These changes will apply to the financial year 2026–27 and will reflect in salary deductions and tax filings.

Also Read: Petrol Diesel Price Drop Today In India: Check Latest Rates And City Wise Updates

Employees may notice revised TDS deductions in their salary slips once the rules come into effect. Actual benefits will be visible during the year and while filing income tax returns.

Final Analysis of Income Tax Relief and Salary Expectations

The New Income Tax Act 2026 focuses on simplifying taxation and providing indirect financial relief. While there is no official salary increase, tax savings may create the effect of higher income.

The estimated ₹25,000–₹80,000 annual gain depends on income level, tax regime choice, and deductions. Understanding these changes can help taxpayers make better financial decisions and maximize their savings.

Also Read: ₹1000 Monthly Support for Ration Card Holders 2026 Full Guide to Benefits Eligibility