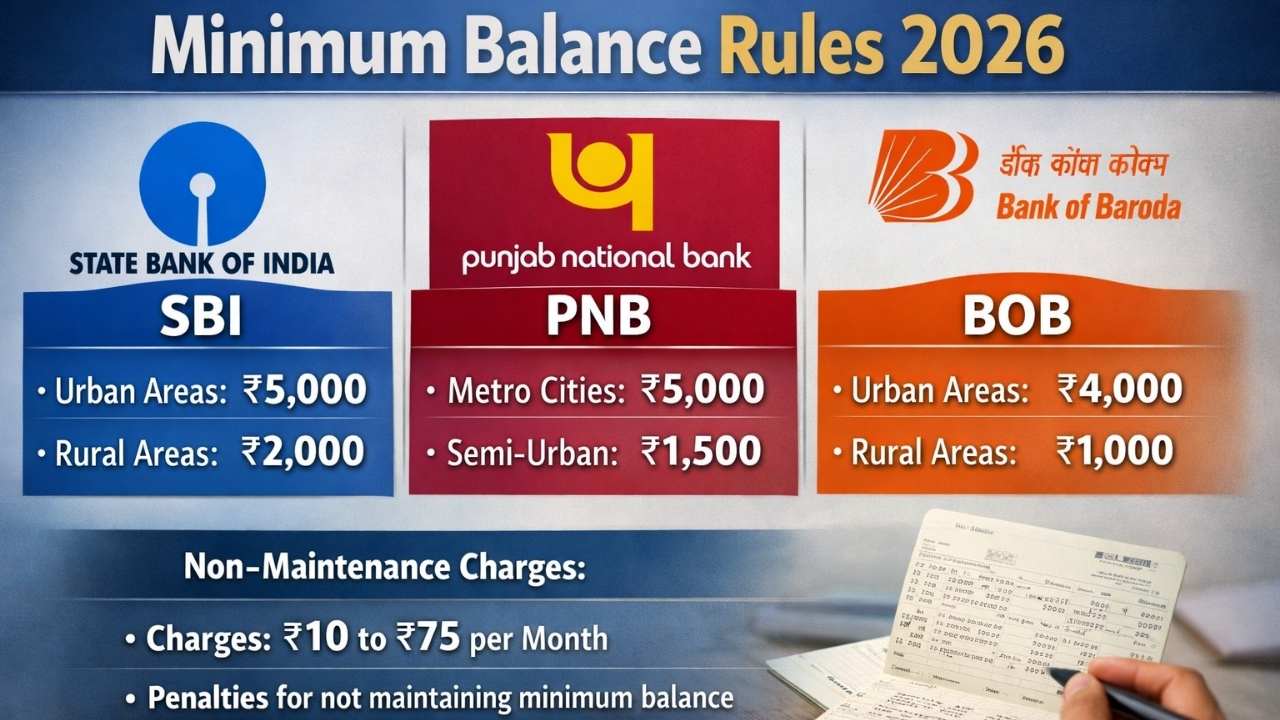

Minimum Balance Rules 2026: Public sector banks like SBI, PNB, and Bank of Baroda have updated their minimum balance rules for savings accounts in 2026. These changes affect how much balance customers need to maintain and the penalties for falling short. Many account holders are unaware that rules vary based on account type and location.

The updates aim to improve digital banking services, manage operational costs, and reduce low-balance account risks. Customers now receive alerts before penalties, and some accounts offer zero-balance options. Understanding these changes can help avoid unnecessary charges and ensure smoother banking experiences.

Also Read: DDA Premium Housing Scheme 2026 Extended Till February 20, Offering Flats In Prime Delhi Locations

Latest Minimum Balance Rules In SBI PNB And Bank Of Baroda

State Bank of India follows a location-based minimum balance system. The required amount varies for metro, urban, semi-urban, and rural areas. Some accounts, especially basic savings accounts, allow zero balance with no penalty for non-maintenance.

Punjab National Bank and Bank of Baroda have also defined balance requirements based on account types and branch locations. These rules help banks maintain stability while encouraging customers to keep a minimum balance in their savings accounts.

Minimum Balance Charges And Penalty Structure In 2026

If customers fail to maintain the required balance, banks may deduct a penalty. In SBI, penalties may range from around ₹20 to ₹200 depending on the area and shortfall. SMS alerts are often sent before the deduction.

Also Read: Top Fixed Deposit Interest Rates February 2026 After RBI MPC Policy Decision Update

PNB and Bank of Baroda also apply charges based on account category and balance gap. The penalty amount varies and may be automatically debited from the account. Charges are typically higher in metro branches compared to rural areas.

Minimum Balance Rules 2026: Overview Table

| Bank | Minimum Balance Requirement | Penalty Range | Special Features |

|---|---|---|---|

| SBI | Location-based; some zero balance accounts | ₹20–₹200 | Alerts before deduction |

| PNB | Around ₹500–₹1,000 depending on area | Varies by scheme | Auto debit charges |

| Bank of Baroda | ₹500–₹3,000 depending on branch type | Yes if shortfall | Digital balance tracking |

Location Based Balance Requirements In Public Sector Banks

Many banks have introduced location-specific rules for minimum balance maintenance. Metro and urban branches usually require higher balances compared to rural and semi-urban branches. This system helps banks adjust services based on customer activity levels.

Customers in rural areas often have lower minimum balance requirements. This ensures financial inclusion while keeping banking accessible. Still, account holders must check their branch category to avoid unexpected penalties.

Also Read: PMAY Urban Scheme 2026 Complete Guide To Eligibility, Subsidy Benefits And Application Process

Zero Balance Account Options And Eligibility Criteria

Certain savings accounts offered by SBI, PNB, and Bank of Baroda allow zero balance. These include basic savings accounts, government scheme accounts, and some salary accounts. These accounts are designed to support people with low or irregular income.

However, not all accounts are zero balance. Customers should confirm their account type to avoid confusion. Keeping track of the minimum balance requirement helps prevent automatic penalty deductions.

Reasons Behind New Banking Rules And Policy Changes

Banks have updated minimum balance rules to manage operational costs and improve digital infrastructure. Increased spending on cybersecurity and technology is one of the key reasons behind these changes. Maintaining a minimum balance helps banks ensure stable account management.

Also Read: Important PAN Card Update 2026: Revised Limits For Deposits, Withdrawals And Property Deals

These rules also help reduce the number of inactive or low-balance accounts. By encouraging customers to maintain funds, banks can offer better services and maintain financial discipline within the system.

Impact Of Minimum Balance Rules On Customers

Students, low-income individuals, and those with multiple accounts may feel the impact of these rules the most. Even a small shortfall can lead to regular penalty deductions if the balance is not maintained properly.

However, timely alerts through SMS and mobile apps help customers stay informed. Monitoring account activity and maintaining a small buffer balance can help avoid unnecessary charges.

Also Read: EPFO EPS Reform 2026: Minimum Pension Hike ₹7500 And Wage Ceiling Increase Details Inside

Digital Alerts And Account Monitoring Features

Banks now use SMS and mobile app notifications to alert customers about low balances. These alerts are designed to help account holders take quick action before penalties are charged.

Digital dashboards also allow customers to check required balance levels and account status. This makes it easier to manage finances and avoid unexpected deductions from the account.

Differences In Minimum Balance Across Account Types

The required balance often depends on the type of savings account. Regular savings accounts may require a higher balance compared to basic or government-linked accounts. Salary accounts may have special conditions depending on the employer arrangement.

Also Read: SBI Investment Reality Check: Truth Behind ₹25000 Deposit And ₹8 Lakh Return Claim

Customers should review their account details to understand the exact requirement. Knowing the correct balance limit helps in planning expenses and maintaining financial stability.

Smart Tips To Avoid Minimum Balance Penalties

Keeping a small extra amount in the account can prevent penalties. Checking account balance regularly through mobile banking is another simple way to stay safe. These small steps can save money over time.

Choosing the right account type is also important. If maintaining a balance is difficult, switching to a zero-balance account may be a better option. This ensures uninterrupted banking without the stress of penalties.

Also Read: Why the 2026 LIC Jeevan Utsav Single Premium Plan Is Ideal For Lifetime Income And Protection