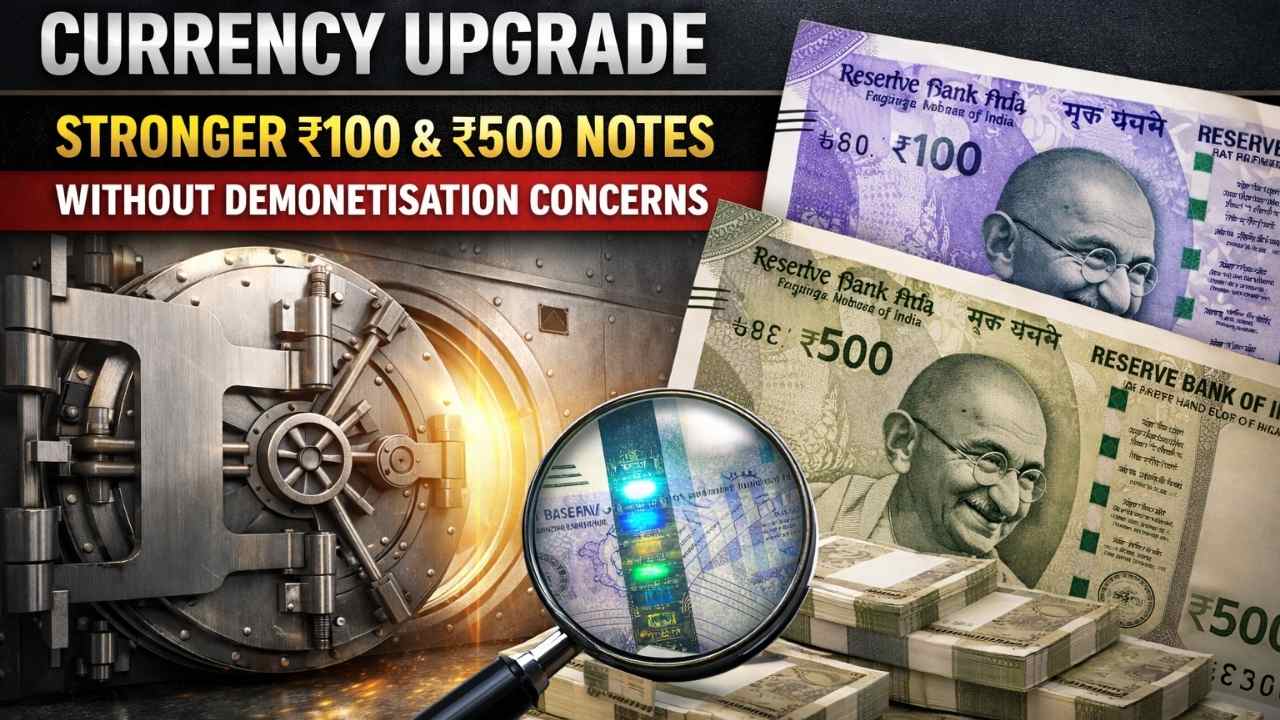

2026 RBI Currency Upgrade: The Reserve Bank of India has introduced updated versions of ₹100 and ₹500 notes in 2026 with improved security and durability. These changes aim to strengthen protection against counterfeiting while maintaining the same value and design familiarity for everyday users.

The move is part of a routine currency update and not a demonetisation. Existing notes will continue to remain valid, and the new notes will gradually enter circulation through banks and ATMs without causing disruption to the public.

Also Read: Bakri Palan Yojana 2026: Eligibility, ₹2 Lakh Subsidy And Application Steps

RBI Introduces Upgraded Security Features In ₹100 And ₹500 Notes

The Reserve Bank of India has started issuing improved versions of ₹100 and ₹500 notes with better printing quality and enhanced safety elements. These updates are designed to protect currency from duplication and improve public confidence in cash transactions.

The upgraded notes are being released slowly into circulation. People can continue to use their current notes without any concern, as older versions remain legal and fully acceptable for payments and deposits.

Reason Behind RBI Currency Update And Security Enhancement

The primary reason for updating these notes is to prevent counterfeit activities and improve note durability. As technology evolves, new security features help protect the currency system from misuse and illegal copying.

Also Read: Compare Top Banks Offering Home Loan Rates 2026: Starting From Affordable 7.10% Interest

Another key goal is to ensure notes last longer in daily use. Stronger paper quality and improved ink can help reduce damage, making the currency more reliable for both urban and rural areas.

2026 RBI Currency Upgrade: Overview Table

| Key Aspect | Details |

|---|---|

| Denominations Updated | ₹100 and ₹500 |

| Purpose | Improve security and durability |

| Legal Status of Old Notes | Remain valid and usable |

| Demonetisation | No |

| Circulation Plan | Gradual release through banks and ATMs |

| Main Benefits | Reduced counterfeiting, stronger notes, clearer features |

Old ₹100 And ₹500 Notes Will Remain Legal Tender

The RBI has clearly stated that existing ₹100 and ₹500 notes will continue to be valid. There is no need to exchange or deposit them unless they are damaged or worn out.

People can continue using old notes for shopping, travel, and daily expenses. Banks and ATMs will accept both old and new versions without any restriction or deadline.

Also Read: PAN Aadhaar Linking Deadline Alert: Complete Process Before March 31, 2026 To Avoid Penalty

No Demonetisation Announcement From RBI In 2026

Many rumors suggested that ₹500 notes might be discontinued, but authorities confirmed that this is not true. The currency update is only a security improvement and not a withdrawal of any note.

There is no official order to stop using current notes. People do not need to panic or rush to banks, as normal cash usage will continue across the country.

Gradual Circulation Of Newly Printed Currency Notes

The new notes are being introduced slowly through routine banking channels. This means people will start receiving them over time from ATMs, banks, and everyday transactions.

Also Read: Post Office PPF 2026 Investment Plan: How ₹50,000 Yearly Can Build Big Future Wealth

This step-by-step circulation helps maintain stability. It ensures that the public can smoothly adapt without confusion or sudden change in cash availability.

Improved Printing Quality And Longer Note Life

The updated notes are expected to have stronger paper quality and better printing techniques. These changes help increase the lifespan of the currency in daily handling.

With improved durability, notes can remain in good condition for longer periods. This reduces the need for frequent replacement and helps maintain a clean and reliable currency supply.

Also Read: Bank Holidays In March 2026: Holi Closures, Long Weekends, And Important Banking Schedule Details

Stronger Protection Against Fake Currency Threats

New security enhancements are focused on making duplication harder. Clearer patterns and improved printing precision make it easier for people to identify genuine notes.

These features help protect the economy from losses caused by fake currency. They also support businesses and banks in maintaining trust in cash transactions.

Public Impact Of The New ₹100 And ₹500 Note Update

For the common public, there is no major change in daily life. The value, size, and basic design of the notes remain familiar and easy to recognize.

The biggest advantage is improved safety and durability. People can continue using cash confidently, knowing that stronger security measures are in place.

RBI’s Long Term Strategy For Currency Safety And Stability

Regular updates to currency notes are part of RBI’s long-term plan to keep the financial system secure. Over time, technology-based security features help reduce risks.

These upgrades show a continued effort to protect cash users and strengthen trust in physical currency. The step supports both modern security needs and the importance of cash in everyday transactions.

Also Read: Gold Rate Slips ₹2,000, Creating Perfect Buying Opportunity Before Wedding Season Demand Surges