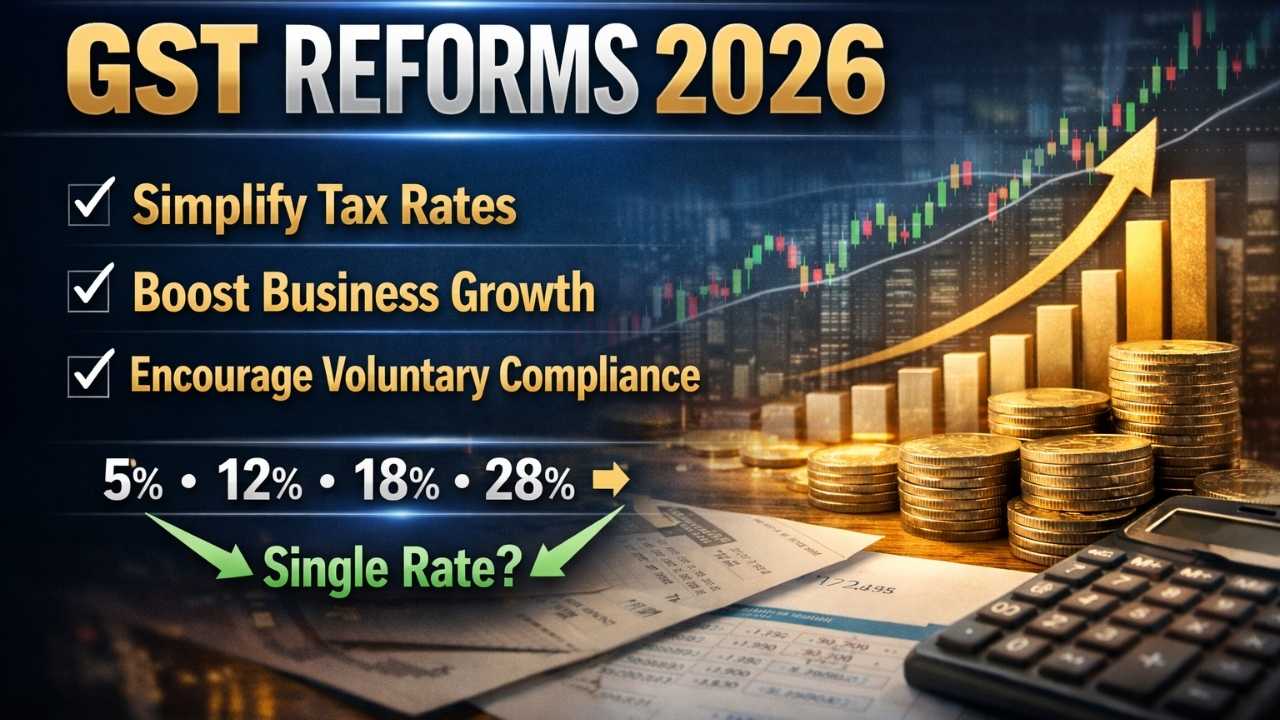

GST Reforms 2026: The New GST Rules 2026 aim to make India’s tax system simpler, more transparent, and business friendly. The reforms focus on reducing tax complexity, encouraging voluntary compliance, and supporting small businesses. These changes are designed to ease financial pressure on traders while improving efficiency in tax collection.

The government has introduced relief in tax rates, simplified compliance procedures, and softened penalties for minor mistakes. The goal is to create a balanced system where businesses can grow without fear of strict enforcement. These reforms are expected to benefit consumers, startups, and MSMEs across the country.

Also Read: School Holiday News Update: Are All Schools And Colleges Closed Till February 25 Nationwide

GST Rate Relief for Consumers and Businesses

The new GST framework focuses on reducing confusion by simplifying tax slabs. Essential items remain in lower brackets, while most goods and services fall under a standard rate. Luxury and sin goods continue to attract higher taxes to maintain revenue balance.

This restructuring helps reduce disputes over classification and improves price stability. Consumers may benefit from lower taxes on daily-use products, while businesses find it easier to calculate and apply GST rates correctly.

Simplified Compliance Process Under New GST Rules

The 2026 reforms aim to make return filing easier and more automated. Many processes are now digital and system driven, reducing manual work and paperwork for businesses. This makes compliance faster and more convenient.

Also Read: New Draft Income Tax Rules 2026 Bring Major Changes To HRA And Hostel Allowance Limits

Small businesses especially benefit from simplified filing systems and composition schemes. These changes reduce stress and allow traders to focus more on growth rather than complex tax procedures.

GST Reforms 2026 Overview

| Key Aspect | Details |

|---|---|

| Purpose | Simplify GST structure and improve ease of compliance |

| Tax Rate Changes | Rationalised slabs with focus on lower and standard rates |

| Compliance | Increased automation and simplified filing processes |

| Penalties | Softer penalties for minor errors and late filings |

| Small Business Support | Easier rules and composition schemes for MSMEs |

| ITC Rules | Stronger validation and system-based checks |

| Administration | Shift toward trust-based tax system |

| Consumer Impact | Possible price stability and reduced tax burden |

Softened Penalties Encourage Voluntary Compliance

The new rules promote a trust-based tax environment by reducing harsh penalties for small mistakes. Businesses are encouraged to correct errors without facing severe punishment. This creates a supportive compliance culture.

Proportional penalties are introduced instead of strict enforcement. This helps traders feel more secure while filing returns and reduces unnecessary fear related to tax compliance.

Also Read: Best Way For Senior Citizens To Earn ₹20,000 Monthly Through SCSS Investment Plan

Impact on Small Businesses and MSMEs

Small businesses are among the biggest beneficiaries of the new GST reforms. Simplified tax rates and easier compliance help them manage financial responsibilities with less confusion.

Composition schemes and relaxed rules support startups and local traders. These changes reduce compliance costs and allow small businesses to grow without facing heavy administrative burdens.

Digital Transformation in GST Filing System

Technology plays a major role in the new GST framework. Automated systems and pre-filled returns help reduce errors and save time for taxpayers. Digital tools also improve transparency in transactions.

Also Read: Labour Wages Increase 2026 Announced With Major Salary Hike For Workers Across Indian States

Online compliance systems make tracking payments and returns easier. This shift supports faster processing and helps businesses maintain accurate records without complicated procedures.

Changes in Input Tax Credit Validation

The new GST rules introduce stricter checks for Input Tax Credit claims. These system-based validations ensure accuracy and prevent fraudulent claims. Businesses must maintain proper documentation.

The focus on matching invoices and digital records improves reliability. This change helps strengthen the overall tax system while ensuring fair practices across industries.

Also Read: Latest Changes In UPI Transaction Rules 2026 For Payments Exceeding ₹2000 Across India

Benefits for Everyday Consumers

Consumers may experience indirect benefits through stable prices and reduced tax burdens on essential goods. Rationalised rates aim to make basic products more affordable.

A clearer tax structure reduces hidden costs in supply chains. This can help maintain fair pricing and improve consumer confidence in the market.

Trust Based Tax Administration Approach

The government is shifting toward a system based on trust and cooperation. Instead of strict enforcement, the focus is on encouraging honest reporting and voluntary compliance.

Also Read: How E-Shram Card Workers Can Get ₹3000 Monthly Pension Through Government Social Security Scheme

This approach builds a positive relationship between taxpayers and authorities. It also reduces unnecessary disputes and promotes a smoother business environment.

Long Term Economic Impact of GST Reforms 2026

The 2026 GST changes are expected to strengthen the economy by improving compliance and reducing tax confusion. Businesses can operate with greater clarity and stability.

Over time, these reforms may increase tax collection efficiency and support economic growth. A simplified tax system encourages investment and helps create a stronger foundation for future development.